[ad_1]

Gen Z is coming into its personal now that its older members are graduating school and beginning their careers. The higher finish of this massive group of customers — roughly 18 to 25 as of 2020 — more and more wants the help and providers of economic establishments. And the remainder of the technology is worthy of early consideration as properly. Though there may be some disagreement in regards to the date vary, usually talking Gen Zers had been born between 1995 and 2015.

As a result of members of every technology are influenced by the occasions and tendencies that assist form their expectations and behaviors, segmenting and concentrating on customers primarily based on their technology can enhance advertising and marketing efficiency.

The six insights on Gen Z laid out under are primarily based on a survey of 1,000 monetary providers prospects by Sure Advertising and marketing. For every perception we give a number of examples of how massive and small monetary manufacturers are adapting their merchandise and advertising and marketing to enchantment to the preferences of this rising technology.

1. Gen Z Is Much less Trusting

Monetary manufacturers are going to must work tougher to earn Gen Z’s belief. Our analysis signifies that they’re much less trusting than previous generations. After we requested monetary customers to rank their causes for utilizing a monetary providers supplier that they had by no means labored with, solely 14% of 18-21 year-olds and 19% of 22-37 year-olds included “belief within the firm to guard private data” of their high three decisions. This compares to a 3rd of 38-52 year-olds and almost half of 53-71 year-olds that cite belief as an element.

Recommendation for entrepreneurs: Assist construct belief by establishing your self as a monetary mentor. Create content material that’s centered on educating younger customers in regards to the fundamentals of banking and investing and create merchandise which are particularly designed to satisfy their wants. As well as, ensure that your model has clear messaging about safety and the way you’ll deal with shopper data.

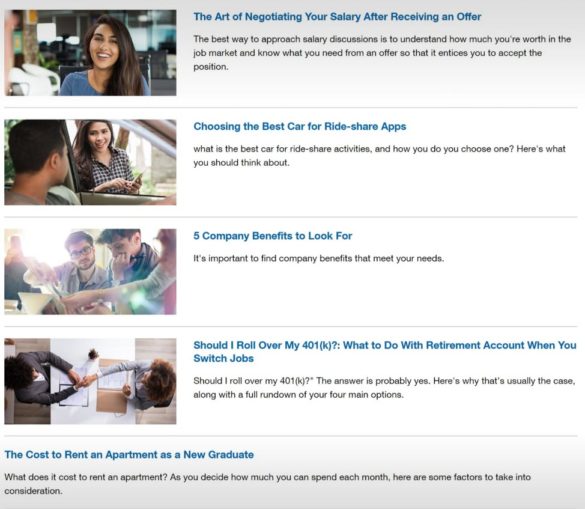

Model instance – Key Financial institution. The large superregional establishes belief by offering steering for younger customers via its Monetary Wellness Middle. Gen Zers profit from useful and related recommendations on navigating life after graduating school, together with details about the price to lease an house as a brand new graduate, or the way to negotiate their wage after receiving a suggestion.

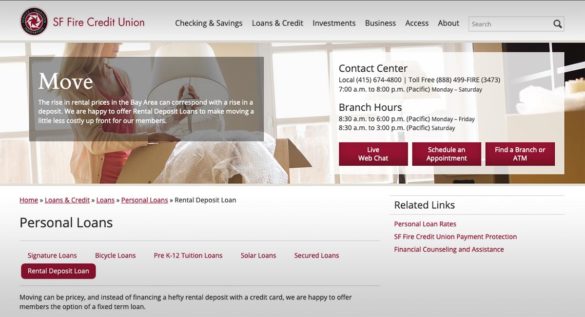

Model instance – SF Hearth Credit score Union. For a lot of younger renters in dear San Francisco, arising with a first-and-last month’s lease deposit is difficult to handle. SF Hearth Credit score Union establishes themselves as a trusted ally and reveals they perceive the battle of Gen Z customers within the metropolis’s famously costly rental market by providing rental deposit loans. As well as, they provide small loans for bicycles, interesting to a technology that’s supportive of other transportation.

2. Gen Z Expects You to Meet Them The place They Are

Younger persons are on the go greater than another technology earlier than them, and depend on expertise to get issues accomplished whereas they zip round. Gen Z is not only fluent in cell expertise — they’re depending on it. This technology is more likely to prioritize the power to handle providers by way of cell as an necessary issue for selecting a brand new monetary establishment. 42% of 18-21 year-olds embrace cell banking functionality of their top-three concerns, as do almost as many 21-37 year-olds (37%). Cell can also be necessary to simply over a 3rd of 38-52 year-olds, however simply 18% of 53-71 year-olds say the identical.

Recommendation for entrepreneurs: To maintain tempo with this viewers, your cell recreation must be “on fleek.” Monetary entrepreneurs could make their model extra interesting to Gen Z by making certain that buyers can handle their monetary duties like funds, requesting credit score will increase, or getting solutions to their questions via cell apps. From a messaging standpoint, letting younger customers understand how your model can assist them handle their funds whereas they’re on the go can enhance your standing as properly.

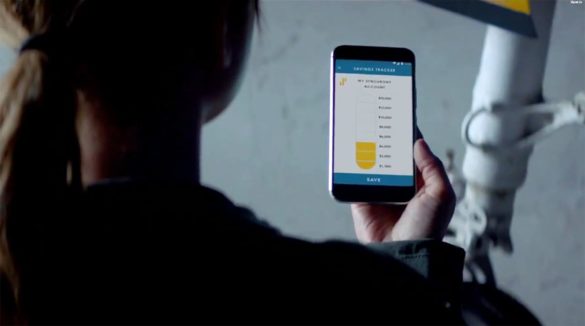

Model instance – Synchrony Financial institution. The net-only financial institution created their “save like a hero” marketing campaign in partnership with Marvel. The multichannel marketing campaign included augmented actuality (AR) and experiential elements in addition to conventional media like a TV spot that featured a fighter pilot who’s impressed by Captain Marvel to save lots of like a hero. The industrial highlights the model’s cell app which features a visible financial savings tracker, designed for reaching targets on the go.

( Learn Extra: 13 Main Insights Into Gen Z Driving Banking Behaviors In 2020 (And Past) )

Model instance – U.S. Financial institution. The fifth-largest financial institution within the U.S. launched an award-winning e-mail marketing campaign to tout the advantages of utilizing their debit card for small purchases. The marketing campaign’s concise copy and clear visuals get straight to the purpose — excellent for busy Gen Z customers.

Learn Extra:

REGISTER FOR THIS FREE WEBINAR

High Digital Tendencies Each Monetary Model Ought to Use

As monetary establishments construct digital methods to raise buyer or member experiences, organizations are racing in opposition to their opponents for better sophistication by way of expertise.

Tuesday, december 17th at 2pm EST

three. Gen Z Depends On the Recommendation of Others

Maybe it’s no shock that the youngest customers rely on the recommendation of family and friends greater than older generations. Our analysis discovered that two-thirds of 18-21 year-olds and simply over half (56%) of 21-37 year-olds say adverse word-of-mouth has deterred them from utilizing monetary providers firms they haven’t beforehand used.

As well as, younger monetary providers prospects usually tend to have realized a couple of new monetary establishment via fee comparability websites like Penny Hoarder or Nerdwallet. One-quarter of 18-21 year-olds and 17% of 22-37 year-olds point out this versus 13% on common throughout all generations.

Recommendation for entrepreneurs: Whereas Gen Z customers depend on their family and friends for enter, they’re additionally adept at utilizing the huge assets of the web to analysis on their very own. Shine a highlight in your model’s status and strengths by highlighting constructive critiques and sharing them along with your youthful viewers.

Model instance – Ally Financial institution. Ally centered on this level with a humorous marketing campaign encouraging customers to pay attention to the financial institution’s constructive critiques and urging them to not accept a “two-star financial institution.” The artistic used quite a lot of intelligent taglines like: “You wouldn’t belief a 2-star sushi restaurant.” To go with the marketing campaign, the model created faux adverts for a couple of of those imaginary one- or two-star companies together with Sam Smiley Dental and Mike Mekanic. As well as, Ally Financial institution integrated interactive banner adverts on web sites the place customers go to acquire scores on services.

four. Younger Shoppers Need To Work together with Your Model On Their Phrases

Gen Z is extra prone to say they hear from monetary manufacturers too regularly throughout virtually all channels than older generations. Gen Zers need to method manufacturers on their phrases and don’t like being disrupted. Particularly, 37% of 18-21 year-olds say they obtain emails too regularly, in comparison with slightly below 1 / 4 (24%) of 22-37 year-olds, 22% of 38-52 year-olds and simply eight% of 53-71 year-olds. As well as, one quarter of 18-21 year-olds say they obtain textual content messages too regularly.

Recommendation for entrepreneurs: Give attention to being there when and the place Gen Z customers want you. Whereas monetary manufacturers have traditionally been extra cautious about experimenting on the latest social channels, like TikTok, some manufacturers are discovering success by getting artistic on extra established youth channels and assembly youthful customers of their pure habitat.

Model instance – American Specific. The cardboard firm harnesses the facility of Instagram influencers with their #AmexAmbassadors program. Amex companions with a whole lot of Instagram accounts with various viewers dimension and matter pursuits — from celebrities to journey fanatics — who obtain perks like being invited to unique experiences and events.

Learn Extra:

[ad_2]

Source link