[ad_1]

JHVEPhoto/iStock Editorial by way of Getty Photographs

eBay (NASDAQ:EBAY) reported delicate leads to Q1 2022 (quarter ended March 2022), following a development seen within the on-line retail house generally. Though the weak spot is prone to proceed close to time period, eBay’s long-term technique might doubtlessly usher in higher days because the technique focuses on enhancing its aggressive positioning which might drive transaction revenues in addition to broaden its higher-margin promoting revenues, and in the end solidify its market main place within the C2C ecommerce house.

Tender numbers in Q1 2022

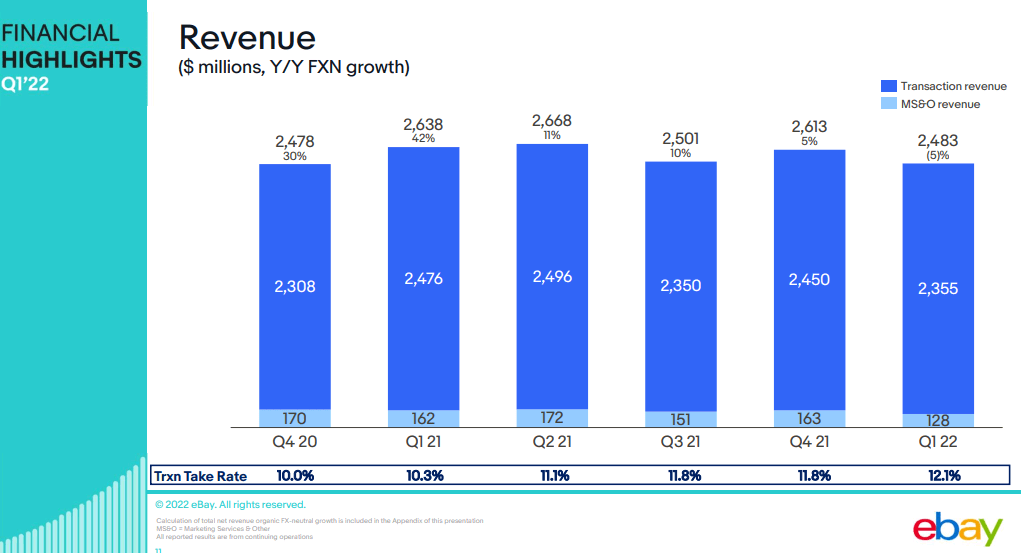

On-line market eBay bought off to a gradual begin this yr; gross merchandise volumes (GMV) slumped 20% YoY to USD 19.four billion, and gross sales dropped 6% YoY to USD 2.5 billion. Gross earnings fell to USD 1.Eight billion, down 12% YoY, whereas working earnings sank 18% YoY to USD 692 million. The corporate swung into the crimson with a web lack of USD 1.34 billion, in contrast with a web revenue of USD 641 million the identical quarter a yr earlier. Present macro headwinds together with slowing shopper demand on account of inflation, cooling ecommerce exercise, and the Ukraine battle had been amongst causes for the softening financials.

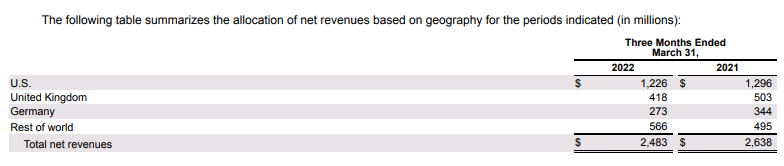

Revenues declined in all of eBay’s high geographies, however the remainder of the world was a shiny spot; revenues within the U.S. – eBay’s largest market – dropped 5.four% YoY to USD 1.2 billion, whereas the UK reported a income decline of 17% YoY to USD 418 million, and Germany revenues dropped 21% YoY to USD273 million. Gross sales in the remainder of the world climbed 14% YoY to USD 566 million.

eBay 10-Q, Q1 2022

Close to time period challenges: pandemic tailwinds petering out plus headwinds from weakening shopper demand on account of excessive inflationary surroundings, battle in Ukraine

After reporting stellar outcomes due to a pandemic-driven ecommerce growth over the previous two years, these tailwinds seem like petering out as lockdowns ease and customers return to shops. eBay in addition to a slew of different ecommerce corporations have reported slowing gross sales and given weak steering this quarter. Demand weak spot related to excessive inflation are including to close time period challenges for on-line retailers, as languishing shopper buying energy cuts into gross sales. The continued battle in Ukraine additional compressed shopper spending (eBay famous decrease site visitors in its key markets of the UK and Germany because of the battle). eCommerce titan Amazon (AMZN) reported a three% YoY decline in on-line retail revenues, whereas Etsy (ETSY) reported a 5.2% YoY improve – marking the primary time revenues grew in single digits.

eBay administration expects close to time period challenges to proceed pressuring efficiency; the corporate tasks Q2 2022 revenues to be between USD 2.35 billion to USD 2.four billion, about 10% decrease than the USD 2.7 billion in gross sales generated the identical quarter final yr.

eBay Q1 2022 investor presentation

eBay’s full-year expectations echo an identical sentiment with administration projecting revenues of about USD 9.6 billion to USD 9.9 billion, about 5% decrease than final yr’s USD 10.four billion.

Long run technique focuses on strengthening C2C ecommerce management, and advancing penetration in differentiated classes

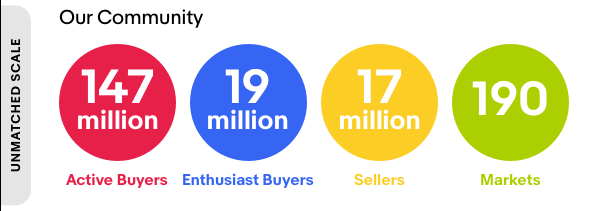

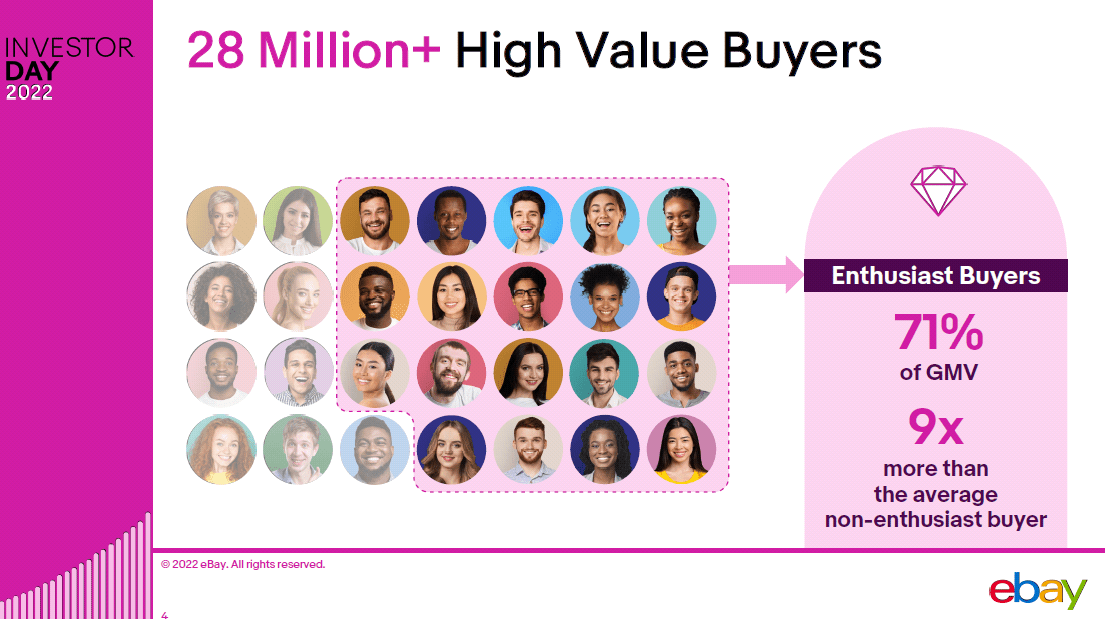

Though eBay’s close to time period outlook is delicate, long term the corporate might see higher days. Having offered off on-line ticket platform StubHub, and its classifieds enterprise, the corporate is now refocusing its consideration on its core C2C market platform. At its investor day held in March this yr, eBay administration outlined the corporate’s long run technique to drive future development; improve give attention to collectibles and non-new-in-season classes reminiscent of sneakers, purses, and watches (termed “focus classes”), and improve give attention to clients of these explicit product classes – which eBay phrases “fanatic patrons”, 94% of whom store in focus classes, and in accordance with the corporate are extra loyal, and have the next common spend (as a lot as 9 occasions the spend of the typical non-enthusiast purchaser). Of eBay’s 147 million energetic patrons, about 19 million or simply underneath 13% had been fanatic patrons.

eBay Investor Day 2022 Presentation

Regardless of accounting for a small proportion of eBay’s total buyer base, this high-value group of shoppers account for a whopping 71% of eBay’s GMV.

eBay Investor Day 2022 Presentation

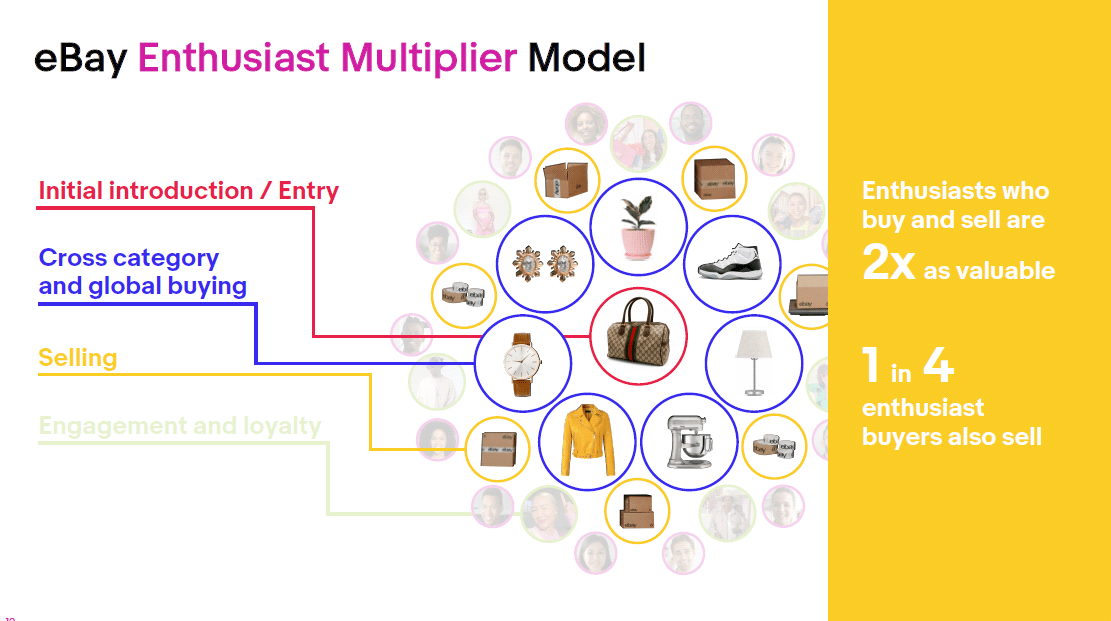

A couple of quarter of eBay’s fanatic patrons (amounting to about 5 million) are additionally sellers on the platform. This prized group of extremely engaged clients are two occasions extra invaluable in accordance with eBay.

eBay fanatic multiplier mannequin

According to eBay’s technique to higher serve this key group, the corporate introduced eBay Vault – a 31,000 sq. foot safe storage facility for buying and selling playing cards and collectibles. The ability affords 24-hour safety for merchandise within the vault, in addition to authentication companies (“Authenticity Assure”) performed by professionals who confirm the product’s authenticity previous to being shipped to the vault. With the product safely within the vault, patrons and sellers can seamlessly promote and make purchases, and within the occasion of a purchase order, patrons can declare instantaneous possession of the product and both have the product shipped to them from the vault or retain the product safely within the vault (for example to resell at a later date through which case the vault affords them the comfort of not having to re-authenticate, re-package, or re-ship the product). eBay additionally introduced plans to launch its personal digital pockets to additional facilitate the transaction course of.

eBay’s technique of specializing in its core C2C market, and that too specializing in a smaller group of shoppers could restrict the corporate’s development going ahead. Energetic patrons for example have already been on a downward development. eBay’s energetic patrons dropped 13% to 142 million in the course of the Q1 2022 quarter. For perspective, energetic patrons had been 180 million in Q1 2019.

At first look this will not sound too thrilling, nonetheless the erosion of energetic patrons is because of the exit of “decrease worth” customers. This isn’t surprising given the corporate’s rising give attention to excessive worth customers, and the tradeoff of dropping decrease worth customers in an effort to higher retain increased worth customers via improved differentiation, a widening aggressive benefit (since smaller gamers could wrestle to supply worth added companies reminiscent of eBay Vault), might ship long run outcomes via elevated buyer loyalty, elevated cross-category purchases, and due to this fact doubtlessly elevated transactions in consequence. Larger person exercise and transactions not solely might drive revenues (the vast majority of eBay’s revenues are derived from a take price on the GMV of transactions paid on their platform) but additionally eBay’s promoting revenues, which whereas at present a small a part of total revenues, might doubtlessly be margin accretive because the phase grows.

eBay 2021 10-Ok

Financials

eBay has had quite lumpy income development charges over the previous a number of years in contrast with friends within the on-line retail house who due to rising ecommerce penetration have been reporting double digit income development charges. Even throughout years of constructive development, eBay has largely reported mid-single-digit development charges (aside from 2021 and 2020 when the pandemic drove an ecommerce growth). This isn’t anticipated to alter going ahead with eBay administration anticipating its long run technique to drive income development of 5%-6% in FY 2023, and seven%-Eight% in FY 2024.

Income development YoY %

eBay | Etsy | Amazon | Shopify | |

FY 2021 | 17.16% | 34.97% | 21.70% | 57.43% |

FY 2020 | 19.72% | 110.86% | 37.62% | 85.63% |

FY 2019 | -14.12% | 35.56% | 20.45% | 47.05% |

FY 2018 | -12.86% | 36.82% | 30.93% | 59.40% |

FY 2017 | 6.76% | 20.90% | 30.80% | 72.94% |

FY 2016 | Eight.22% | 33.44% | 27.08% | 89.70% |

FY 2015 | -2.25% | 39.83% | 20.25% | 95.43% |

FY 2014 | 6.46% | 56.45% | 19.52% | 108.98% |

FY 2013 | -41.32% | 67.59% | 21.87% | 111.92% |

FY 2012 | 20.77% | – | 27.07% | – |

eBay’s gross margins nonetheless have held up fairly effectively in comparison with Shopify (SHOP) whose margins have been on a downtrend, though nowhere close to nearly as good as Amazon whose margins have been on a transparent uptrend. Enlargement of the corporate’s higher-margin promoting revenues might assist margins going ahead.

Gross margin %

eBay | Etsy | Amazon | Shopify | |

FY 2021 | 74.57% | 71.90% | 42.03% | 53.80% |

FY 2020 | 79.80% | 73.07% | 39.57% | 52.62% |

FY 2019 | 78.66% | 66.88% | 40.99% | 54.85% |

FY 2018 | 76.61% | 68.40% | 40.25% | 55.56% |

FY 2017 | 77.63% | 65.95% | 37.07% | 56.48% |

FY 2016 | 78.45% | 66.21% | 35.09% | 53.81% |

FY 2015 | 79.39% | 64.54% | 33.04% | 55.18% |

FY 2014 | 81.08% | 62.35% | 29.48% | 58.84% |

FY 2013 | 81.93% | 61.78% | 27.23% | 73.11% |

FY 2012 | 70.04% | 67.17% | 24.75% | 79.86% |

Abstract

Weakening shopper demand on account of an inflationary surroundings and a post-pandemic return to in-store purchasing is contributing to softening efficiency for many on-line retail platforms and eBay isn’t any exception. The softness is predicted to proceed within the close to time period. Long term, the corporate’s shift away from basic ecommerce to excessive worth customers and choose focus classes by itself platform could restrict its development, however on the identical time, the corporate is enhancing its aggressive positioning and differentiation which might drive buyer loyalty, and elevated platform transactions, which in flip might drive transaction revenues in addition to its higher-margin promoting revenues, and in the end solidify its market-leading place within the C2C ecommerce house.

[ad_2]

Source link