[ad_1]

(Picture by Ezra Acayan/Getty Photographs)

Getty Photographs

Expensive markets with financial headwinds are all the time susceptible. That’s The underside line.

The Dow dropped over 600 factors on Friday. That’s nothing new, as this occurred loads of instances in 2018. And, it’s solely someday. However wait, there’s extra.

You see, this section of the lengthy bull market cycle that began in 2009 is giving us increasingly clues on a regular basis. The trick is to piece them collectively. And, you must preserve your humility and frustration when everybody round you appears to suppose the occasion simply began. Extra seemingly, it’s near ending.

The Coronavirus is a horrible improvement from a human well being standpoint. Secondarily, it’s inflicting governments and companies to make troublesome selections. Nonetheless, there’s one factor that the monetary media does each time one thing like this comes alongside. And, its doing it once more.

Markets have been dismissing developments within the international financial system and the inner situation of the inventory marketplace for about three years. That reveals a powerful will on behalf of traders to remain constructive. That’s good. Nonetheless, it solely extends the bull market. It doesn’t make it vanish just like the Depraved Witch of the West.

Understanding that, if we merely take account of what else is happening, now that the Coronavirus is stoking concern and financial alarm throughout the globe, we are able to resolve what to do subsequent with our property. I’ve defined that as a part of an ongoing dialogue on this area for a few years. Now that the “one thing” got here alongside to doubtlessly prick the inventory market bubble, let’s take a bottom-line view of what the funding panorama appears like, proper now.

I monitor an ongoing record of potential investor stress factors. Listed below are just a few which have shortly develop into essentially the most distinguished, given Friday’s sudden inventory market tumble.It’s falling at an accelerating tempo.

International financial progress

The Institute of Provide Administration (ISM) Manufacturing Survey fell laborious late final yr. Extra lately, final Friday’s Chicago Buying Supervisor’s Index Information signaled that issues are getting worse, not higher for the worldwide financial system. Sarcastically, after all of the back-and-forth over China-U.S. commerce relations, China’s financial system is now transporting an financial recession anyway. Among the weaker European nations are already there.

Sentiment was too robust

A wide range of formal and casual sentiment indicators have been flashing warning indicators for months. A few of this may be simply documented. Others are extra about what these of us who had been managing cash in the course of the Dot-Com buildup and bubble felt like. And, the similarities to right now’s atmosphere are hanging.

Nonetheless, none of that issues till inventory costs dive. As I famous elsewhere late final yr: I’ll really feel that we’ve reached the highest of the bull market once we get one thing extra confidence-shaking. I feel that’s extra seemingly in 2020.

Maybe the rising weak spot of the market situation made it vulnerable to an sickness out of left subject, so to talk. That sickness seems to have come within the type of the Coronavirus.

S&P 500 Index-Envy

S&P 500 index funds have primarily develop into the “slam-dunk” of our era. The investing public has been conditioned to suppose that the S&P 500 is “the market.” At first of bull markets, when every little thing is means down, that is smart to me. Nonetheless, because the bull rolls one, it requires extra cautious evaluation than that.

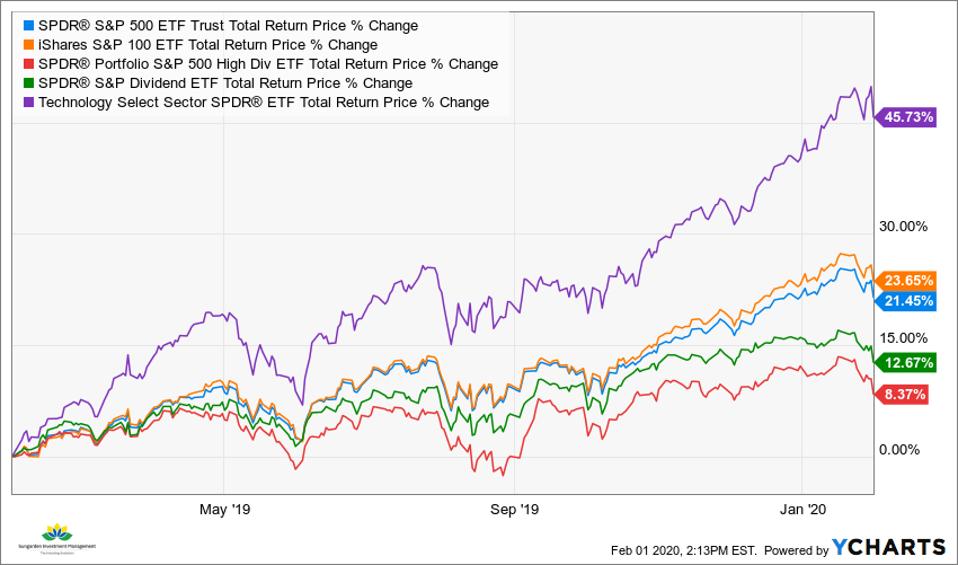

Here’s a fast take a look at what I imply. This reveals the S&P 500 and varied slices of it over the previous 12 months. The “headline” index is in blue, up over 21% throughout that point. Nonetheless, the tech sector, which makes up over 20% of the S&P 500, is up greater than double that! And, inside that sector, a small variety of shares are carrying the load. That is traditional late bull market habits.

Additionally, see the crimson and inexperienced traces on the backside. That reveals you that dividend shares basically have severely lagged the “headline” S&P 500 Index. And, the crimson line reveals an ETF that tracks lots of the highest-yielding S&P 500 part shares. Backside-line: when dividends are handled as means much less essential by traders, it’s an indication of overconfidence. Mrs. Market likes to eat that for lunch.

SPY_OEF_SPYD_SDY_XLK_chart (1)

Ycharts.com

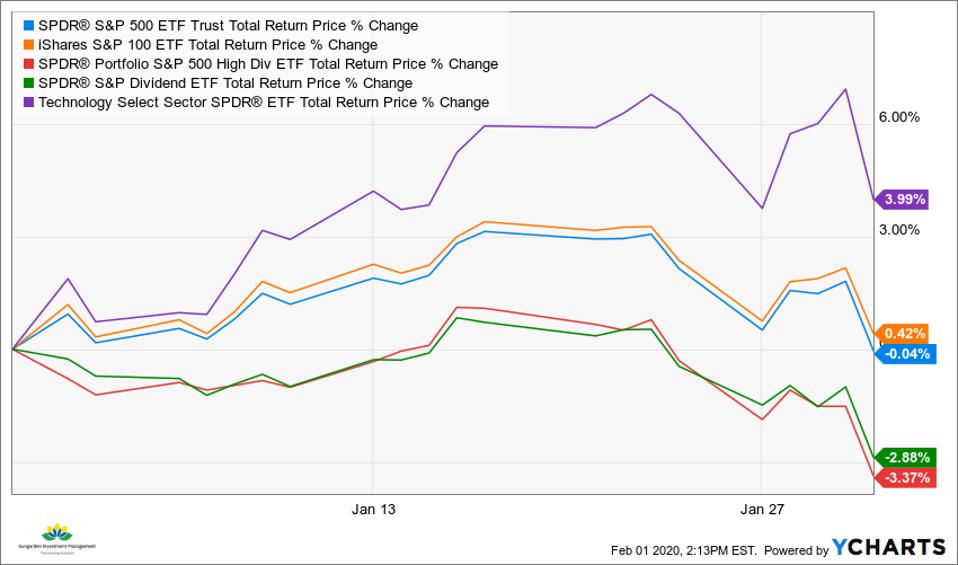

Right here is identical set of S&P 500 and slices, however only for January of this yr. Tech means up, total index up till Friday’s plunge, and dividends shares handled like rubbish. That every one checks out to me. It is a market decline value being attentive to.

SPY_OEF_SPYD_SDY_XLK_chart

Ycharts.com

Past the Coronavirus fears

Importantly, all of those market and financial illnesses all predated the outbreak of the Coronavirus. Nonetheless, in case you are it with some actual perspective, it was solely going to take one shock to the system to tip issues over. It’s as if the market had its fingers crossed for months. However that outdated superstition didn’t work this time. Think about that!

Subsequent step for anybody nearing or in retirement

If you’re nearing retirement or already in it, that is the perfect time to undertake a hedged investing strategy. That’s, don’t simply depart it to the market to work all of it out for you. 60/40 portfolios are a advertising gimmick that occurred to work properly for some time, since shares and bonds had been in bull market mode. That’s altering quickly, as Friday reminded us. Anticipate extra warnings within the close to future.

As for what to do, the secret’s to not stand nonetheless. I’ve written a number of articles about options to conventional funding approaches, so peruse these for a extra sturdy image. As we observe the observe by means of from Friday’s drop, I plan to be energetic in my commentary right here, so keep tuned.

Feedback offered are informational solely, not particular person funding recommendation or suggestions. Sungarden supplies Advisory Companies by means of Dynamic Wealth Advisors

[ad_2]